Posted on October 29, 2012.

AMEX Wins Cancellation of BLACKCARD Trademark Registration

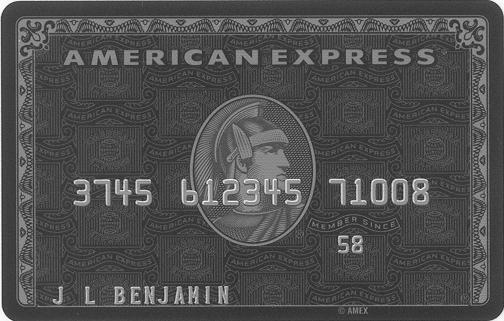

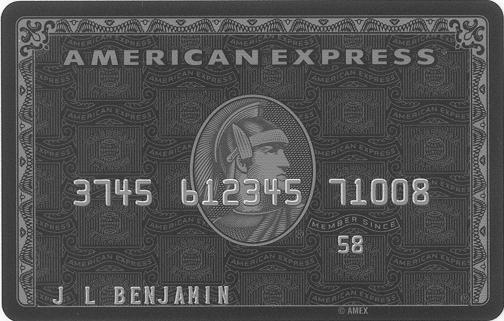

American Express (“Amex”), the issuer of the ultra-exclusive “

Centurion Card” credit card (which is black in color and thus better known among the public as the “Black Card” — pictured above), won a victory in the U.S. District Court for the Southern District of New York against

Black Card, LLC (“BC”), a company that obtained a trademark registration for the mark

BLACKCARD (for credit and debit card services). The Court granted summary judgment in favor of Amex on its claim that BC’s trademark registration for BLACKCARD should be canceled on the grounds that it is merely descriptive and BC had not demonstrated acquired distinctiveness.

See American Express Marketing and Development Corp, et al. v. Black Card, LLC, 2011 U.S. Dist. LEXIS 133151 (S.D.N.Y. November 17, 2011)

In 1998, Amex, following its long history of color-based credit cards reflecting a hierarchy of credit card prestige (i.e., green, gold, platinum), developed a black colored credit card which it called the Centurion Card and which was available by invitation only. While Amex never formally refers to the Centurion Card as the “Black Card,” Amex executives recognized that the public referred to its Centurion Card as the “Black Card” and thus often informally referred to the card as Amex’s “black card.” While Amex applied to register BLACK FROM AMERICAN EXPRESS, it never filed a Statement of Use and the application went abandoned.

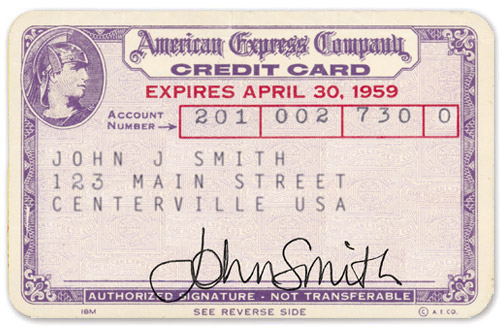

(The other “Black Card”)

In 2008, BC began issuing its own card (in connection with Barclays Bank Delaware and Visa) which was black in color and which had the words “BLACK CARD” emblazoned theron (pictured above). BC’s CEO Scott Blum, who founded Internet retailer Buy.com and who was a Centurion cardholder since Amex first introduced the card, began developing his black-colored premium credit card back in 2005 when he was CEO of Internet company called Yub, Inc. Blum, apparently frustrated with Amex’s Centurion services, sought to build a “better Black Card.” Yub applied for the BLACKCARD on September 20, 2005. The mark was published for opposition in May 2006 and, when no oppositions were filed, the PTO issued a Notice of Allowance in 2006. Yub later assigned all of its rights to the as-yet-unregistered mark to BC. [Query: Was this assignment of an intent-to-use application even valid under 15 U.S.C. § 1060? – see actual recorded assignment]

BC (and its predecessor) filed thirteen applications total between 2005 and 2009 for various BLACK CARD marks. Some were refused on the grounds that the mark was merely descriptive; in others, Examining Attorneys requested information from BC about whether consumers would associate the mark with a different provider of credit card services. Nonetheless, the PTO did issue the aforementioned trademark registration on April 29, 2009. However, for reasons not entirely clear, even though BC’s attorney had filed a preliminary amendment which inserted a disclaimer of the term BLACK apart from the mark as shown, the registration certificate did not reflect the disclaimer when it issued.

On May 13, 2009, Amex filed a petition to cancel with the Trademark Trial and Appeal Board. See American Express Marketing & Development Corp. et al v. Black Card, LLC, Cancellation No. 92050968 (TTAB). On February 16, 2010, BC filed an action in Wyoming that sought a declaratory judgment regarding Amex’s rights to “Black Card” as well as other trademark and unfair competition claims. On February 26, 2010, Amex filed the instant action in New York District Court alleging its own trademark and unfair competition claims as well as seeking to cancel BC’s registration under §2(e) of the Lanham Act. The TTAB’s proceeding was suspended on May 7, 2010, pending the outcome of the lawsuits. Moreover, Amex was able to get BC’s Wyoming complaint dismissed as an anticipatory filing. BC later refiled its counterclaims in the New York action. The parties later stipulated to have Amex’s claims for monetary damages and BC’s federal and state trademark infringement and unfair competition claims dismissed with prejudice. Upon close of discovery, the parties filed cross motions for summary judgment, with Amex moving for partial summary judgment on its §2(e) cancellation claim.

The court’s decision goes into a lengthy (but informative) discussion of its power to determine the right to registration of a mark, the standard for refusing registration of marks which are “merely descriptive” when used on or in connection with the goods/services of the applicant, the spectrum of distinctiveness with respect to protection of a mark (i.e., generic, descriptive, suggestive, arbitrary, and fanciful), and the rebuttable presumption which arises a mark that is registered by the PTO.

Regarding the rebuttable presumption, the court stated:

When the PTO issues a certificate of registration for a mark, a rebuttable presumption arises that the mark is protectable. Papercutter, 900 F.2d at 562-63. “Registration by the PTO without proof of secondary meaning creates the presumption that the mark is more than merely descriptive, and, thus, that the mark is inherently distinctive.” Lane Capital, 192 F.3d at 345. The fact of registration, however, “shall not preclude another person from proving any legal or equitable defense or defect . . . which might have been asserted if such mark had not been registered.” 15 U.S.C. § 1115(a). The party challenging the registration “bears the burden to rebut the presumption of [the] mark’s protectability by a preponderance of the evidence.” Lane Capital, 192 F.3d at 345. “The presumption may be rebutted by a showing that the mark is descriptive, not suggestive.” Papercutter, 900 F.2d at 563.

The presumption, in short, is a “procedural advantage” to the registrant and nothing else. Lane Capital, 192 F.3d at 345. It is not “itself evidence of how the public actually views the mark.” Id. “The presumption of validity that federal registration confers evaporates as soon as evidence of invalidity is presented. Its only function is to incite such evidence, and when the function has been performed the presumption drops out of the case.” Id. (citation omitted).

So while the court gave BC’s BLACKCARD registration its appropriate rebuttable presumption of protectability by virtue of its 2009 PTO registration, the court found that Amex had demonstrated by a preponderance of the evidence that the mark is descriptive was descriptive, and thus not protectable absent secondary meaning. The court also found that “No reasonable factfinder could find that a prospective consumer would consider the mark to be suggestive rather than descriptive.” The court first noted that BC’s mark BLACKCARD appears on a black-colored credit card. “As with other credit cards, it enables its holders to make purchases on credit. The black color of the card is an essential feature or characteristic of the card. BC’s advertising emphasizes the color, underscoring this point.” The court further noted that the word BLACK is descriptive in a second sense within the credit card industry:

Within the credit card industry, the word “black” is descriptive in a second sense as well. Largely through the efforts of Amex, the word “black”, when used in connection with credit cards is understood to describe access to premium credit card services. Indeed, this was the very reason that Blum chose the mark “BLACKCARD” for his credit card. The term “BLACKCARD” immediately calls to mind an important aspect or characteristic of the product and describes the product’s principal features and qualities. It is, in essence, communicating the grade of credit card offered by BC. The black-colored credit card marketed by BC is central enough to the overall product, however defined, to render “BLACKCARD” a descriptive mark.

Finally, following its determination that BC’s mark was descriptive, the court further found that BC had offerred no evidence of secondary meaning accruing to the mark BLACKCARD in order to support an argument of acquired distinctiveness.

BC attempted to argue that Amex lacked standing to seek to cancel BC’s mark, but the court rejected such arguments finding that Amex had “a significant, concrete, and real interest in proceedings to challenge the registration” based on its own use of the term “black card” in communications to prospective customers about the Centurion card (and noting that BC sued Amex for infringement).

BC also attempted to argue that its mark is not descriptive, but instead is suggestive of high-end financial services (citing cases where the color RED was held to be a protectable mark in connection with perfume and scotch whiskey). However, with respect to the Red Label mark on scotch whiskey, the mark did not serve as a grade designation; and with respect to RED on perfume, such reference suggested romance and passion to the prospective purchasers. In the instance case, the court found that BLACKCARD “merely describes the color of the card and the category of credit card services into which BC’s card falls.”

As such, the court granted ary judgment for Amex on its cancellation claim under § 2(e) of the Lanham Act.

Republished from: http://www.vegastrademarkattorney.com/2011/11/amex-wins-cancellation-of-blackcard.html

Someone recently updated

Someone recently updated

Two weeks ago

Two weeks ago

If you’re in NY, exhibit is held @

If you’re in NY, exhibit is held @

A few of our readers that have the Visa Black Card just let us know that the received a monthly newsletter stating that there will be a Black Card 2009 Rolex Giveaway. The letter states that card members are automatically entered in a drawing to win, and one card member will be selected at random on December 31, 2009 and will receive a $10,000 Rolex gift card that is redeemable at an authorized Rolex dealer. Primary account holders in good standing are eligible for the drawing.

A few of our readers that have the Visa Black Card just let us know that the received a monthly newsletter stating that there will be a Black Card 2009 Rolex Giveaway. The letter states that card members are automatically entered in a drawing to win, and one card member will be selected at random on December 31, 2009 and will receive a $10,000 Rolex gift card that is redeemable at an authorized Rolex dealer. Primary account holders in good standing are eligible for the drawing.

Paper, Plastic, Titanium, and Carbon Graphite?

Paper, Plastic, Titanium, and Carbon Graphite?

2008 of course brought the “Visa Black Card“, made from Carbon Fiber. The Wikipedia editors, however, did neglect to include credit cards in applications of carbon fiber (we’re kidding): “The properties of carbon fiber such as high tensile strength, low weight, and low thermal expansion make it very popular in aerospace, civil engineering, military, and motorsports, along with other competition sports.”

2008 of course brought the “Visa Black Card“, made from Carbon Fiber. The Wikipedia editors, however, did neglect to include credit cards in applications of carbon fiber (we’re kidding): “The properties of carbon fiber such as high tensile strength, low weight, and low thermal expansion make it very popular in aerospace, civil engineering, military, and motorsports, along with other competition sports.”