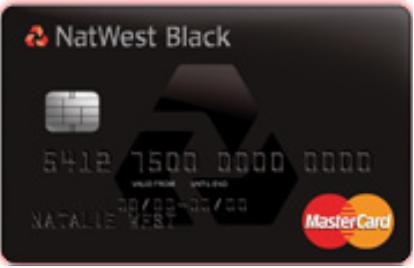

In 2002, NatWest bank in the United Kingdom launched their own Black Card, which is only available to customers with an income of £75,000 or above and over 25 years of age. Approval is subject to status and conditions. The NatWest Black Card has an annual fee of £250, with a minimum credit limit £15,000. The card has a typical 51.8% APR (variable), and cardholders are therefore advised to make more than minimum balance payments. Benefits of the card include personal assistance for gift-shopping and event planning; executive airport lounge access; NatWest YourPoints redeemable for flights; roadside assistance throughout the UK and Europe; card and purchase protection; travel insurance; exclusive offers and access to prestigious events; and, home emergency coverage.