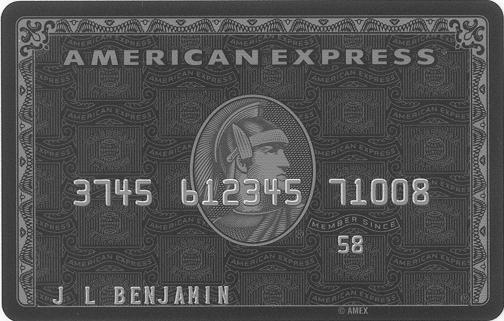

How to Get an American Express Centurion Card (Black Card)

*****THIS GUIDE IS NO LONGER VALID, AMERICAN EXPRESS TURNED THE CENTURION CARD BACK TO INVITATION ONLY OCTOBER 2009*****

History

The Centurion Card aka Black Card aka Black AMEX started out as an urban myth regarding a credit card that turned reality on October 14, 1999. “There had been rumors going around that we had this ultra-exclusive black card for elite customers,” says Doug Smith, director of American Express Europe. “It wasn’t true, but we decided to capitalize on the idea anyway. So far we’ve had a customer buy a Bentley and another charter a jet.” This is where it gets a bit crazy, as many people still know more than of the rumor than the actual card, whose requirements have adjusted since it’s original inception in 1999.

Despite all the mystery and hooplah, the Centurion Card is simply a higher form of the American Express Platinum Card; If you’re familiar with traditional American Express cards, they work the same way, there is no “specific limit” per se, but the limit is set according to your relationship with American Express, just as with the Green, Gold, and Platinum cards. As for benefits, well the Centurion Card has a long list of benefits the other cards don’t, most notably automatic elite status on multiple airlines such as Continental, Delta, US Air, Virgin, etc. (Please see the benefits page for more detail)

Eligibility

American Express has changed the Centurion Card back to Invitation only as of 10/2009.

- The American Express Centurion Card is Invitation Only Again

- Have been an existing American Express Platinum cardholder for a minimum of 1 year.

- Spend $250,000 USD (and pay off) within a rolling 12-month period.

Starting from zero?

If you’re starting from zero, the best thing to do is probably sign up for traditional American Express Card. By traditional card I mean the Green, Gold or preferably the Platinum Card. Keep in mind that if you are not approved for the Platinum Card out of the gate it is still best to get a Green card, as you can work towards getting upgraded to Platinum over time.

Secondly, a point often looked over is that the $250,000 is counted in aggregate spend across all personalAmerican Express Corporate Card spending is not eligible spend. Finally, should you trust others, you may choose to add them as additional card members on your account, as this spending counts against the primary card holder as well. American Express cards under the account holder. This means that you do not have to run everything across your American Express Platinum Card, you may choose to, for example, run charges on your Clear from American Express Card, and pay them later (traditional American Express cards, Green, Gold, Platinum, Centurion, are dull in full each month). Further, if you have a traditional American Express (Green, Gold, Por latinum) Business Card, this is considered personal, as it is essentially derived from your personal credit report and history. Please note:

- Sign up for a traditional American Express Card (Green, Gold, preferably the Platinum Card). Requirements for the Platinum Card are a minimum annual income of $100,000, and a minimum credit score of 630 (at least that is what it was before the credit crunch started). Click here to get FICO Scores and Credit Reports from MyFICO.com, instantly.

- Sign up for a traditional Credit Card with American Express such as the Blue American Express Card (to allow flexibility with payments, like normal credit cards).

- Add additional cardmembers, spouses, siblings (someone you trust, this is your credit!)

- Spend $20,833.33 a month over a rolling twelve month period.

Spend a lot, and make sure it’s all via AMEX

It may seem somewhat impossible at first, unless you truly do make a fortune like Jay Z and Britney Spears, but it can be done. Keep in mind some of the following:

- Pay rent or mortgage if possible with your American Express card.

- Use Bill Pay features and pay all possible bills with the card: Wireless, Utilities, Telephone, Internet, Insurance.

- Avoid using all other cards if possible and make all charges across your personal American Express cards.

- If you own your business charge all possible business expenses on the cards, if you work for a company run all corporate expenses that are eligible to be expensed via personal credit card (airfare, hotel, car rental, meals, etc)

- If you are a small business owner run all expenses possible through the card.

Apply for the Card

It’s no longer invitation only, so if you have the American Express Platinum card, and you think you’ve spent over 250k in the past 12 months, then call up and find out 1-800-528-4800. The Platinum Representative will gladly tabulate your spend and see if you qualify for the card.

If you’re accepted congratulations! And by the way, you’ll be billed $5,000 initiation fee, and $2,500 for annual membership, for a total of $7,500 due at the end of the first billing cycle after having received the card (approximately 30 days).

Also, here are some books that might be helpful:

Howdy could I use a few of the insight found in this website if I produce a hyperlink again to your website?

if u want a real black american express card and can afford it, email icurme @ gmail.com